Key Points

- Investing in an passive fund, benchmarked to the S&P 500® Index can lead to exponential growth over time.

- Using the rule of 72, we show how investment capital can double about every ten years.

- With a long enough timeline, this simple notion can lead to incredible wealth creation.

“Keep it Simple”

Back in highschool, this was the one and true mantra that my Varsity tennis couch would profess to us on almost a daily basis. The notion is that in order to win a tennis match, one doesn’t need a bunch of fancy tricks and complicated strategies. Most of the time if you can just consistently return your opponents ball, you can do quite well. Slow and steady, as they say.

When it comes to investing, this is ever more true. Wall Street has an insatiable ability to dream up fancy and novel investment products, such as junk bonds, pink sheets, strips, and iron condors, to name a few; then there are the acronyms, such as MBS, CDS, ABS, and VIX, to name another few. There are literally thousands of ways to invest your hard-earned capital. But it’s amazing how far you can get if you just keep it simple; i.e., just passively investing in a stock index fund, such as one that is benchmarked to the S&P 500® Index.

Rule of Thumb

We noted earlier in this series that the S&P 500® Index can provide investors with favorable inflation-adjusted returns in the range of 6-7% per year on average with dividends reinvested. We also described how a humble $1500 investment can grow to over a million dollars over a 95-year period.

Now, let’s use a very simple and easy to remember shortcut to better internalize these growth numbers, once again leveraging the rule of 72. The notion here is that with about a 7.2% percent annual return, your money will double every ten years. Further, if this annual return is already adjusted for inflation the spending power of your money will likewise double every ten years.

This is due to the magic (read: math) of compounding interest. The math is quite simple:

Future Value = Present Value * (1 + Annual Return)^(Number of Years)

Future Value = $1.00 * (1 + 7.2%)^10 = $2.00

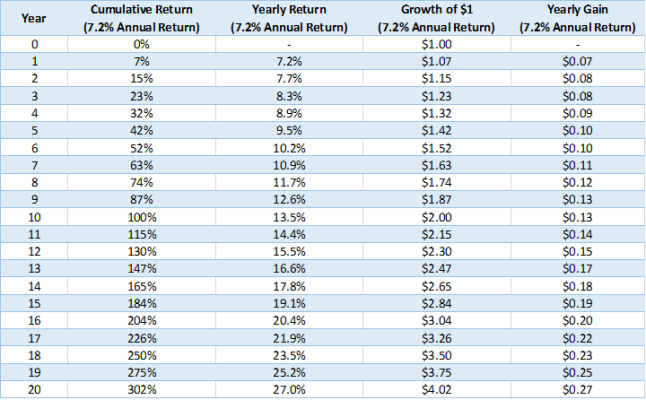

In the formula above, we grow a dollar for 10 years at a 7.2% annual return. This shows that one dollar grows to two dollars after 10 years. So 7.2% a year compounded for 10 years is not a 72% cumulative return, but rather a 100% cumulative return. And after 20 years you end up with a 144% cumulative return (7.2% times 20), but rather something closer to 302%! Indeed, over this longer period more than have of the gains are due to compounding alone.

For reference, Table 1 above details the growth of a dollar over this 20 year period. Notice something very interesting from this table. In the first year, the gain is only 7 cents (as you would expect); but by year 20, the gain is 27 cents. In percentage terms, you would have earned 7.2% on your original dollar, but by year 20, you end up earning about 27% on your original dollar in that year alone.

Summary

Note, this analysis doesn’t include the impact of taxes and fees; but, as we’ve noted in the past, with a passive investing strategy, the impact of fees can be mitigated. As far as taxes are concerned; something to consider is that if you never sell, you never have to pay realized capital gains on the bulk of your investment. Although this may sound strange at first, there’s much sense to this idea. However, we’ll be sure to touch upon this notion towards the end of this series.

To summarize, using the rule of 72 (assuming a 7.2% annualized real return), we see that after 10 years, your $1 turns into $2, and after another 10 years, your $2 turns into $4. You can extend this farther in time by just multiplying by 2 every 10 years. So after 30 years, your $4 becomes $8, after 40 years your $8 becomes $16; and after 50 years your $16 becomes $32. Of course, the more you start with, the more you end with. So if you start with $10,000, then after 50 years you would have $320,000, inflation adjusted. Not a bad way to plan for retirement, right?

However, in my next post we’ll examine what happens after 200 years, and we’ll consider why thinking this long-term (perhaps even Investing Forever) is sensible even though we’re now talking about a holding period that’s longer than the average lifetime.